How Merchant Services Work for Retailers

Merchant services in California refer to a range of financial services that help businesses, particularly retailers, to process payments made by their customers. These services are crucial for retailers as they enable them to accept various forms of payment, including credit and debit cards, mobile payments, and e-wallets. In this blog post, we will explore the different types of merchant services available, how they work, the benefits they offer retailers, and the factors to consider when choosing a merchant services provider.

What are merchant services?

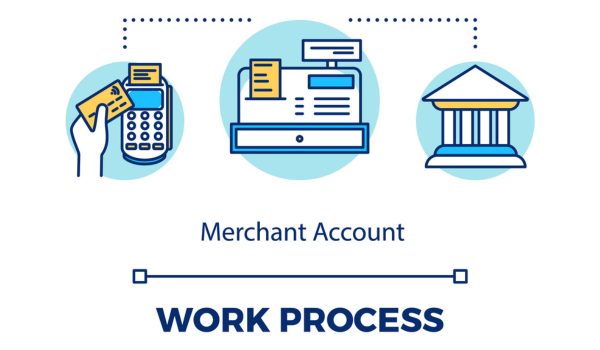

Merchant services refer to financial services that enable businesses to accept electronic payments made by their customers. These services include payment processing, which involves verifying the payment details, approving the transaction, and transferring the funds to the retailer's account. Merchant services also include payment gateway services, which facilitate the transfer of payment information between the customer's bank and the retailer's bank, and merchant account services, which provide the retailer with an account to receive the funds from the transaction.

How do merchant services work for retailers?

When a customer makes a payment using their credit or debit card, the payment information is transmitted to the retailer's payment gateway service provider. The payment gateway service provider then sends the payment details to the payment processor, which verifies the payment details and approves the transaction. The payment processor then transfers the funds to the retailer's merchant account. The entire process typically takes a few seconds.

Merchant services also involve the use of technology, such as point-of-sale (POS) systems and card readers, to enable retailers to accept different forms of payment. Payment gateways and payment processors use encryption technology to ensure the security of payment information and reduce the risk of fraud.

Benefits of using merchant services for retailers

Merchant services offer several benefits to retailers, including increased efficiency and speed of payment processing, improved security and reduced risk of fraud, and access to a wider range of payment options for customers.

- Increased efficiency and speed of payment processing: Merchant services enable retailers to process payments quickly and efficiently, reducing the time customers spend waiting in line. By accepting various forms of payment, such as credit and debit cards, mobile payments, and e-wallets, retailers can provide a seamless payment experience for their customers.

- Increased efficiency and speed of payment processing: Merchant services enable retailers to process payments quickly and efficiently, reducing the time customers spend waiting in line. By accepting various forms of payment, such as credit and debit cards, mobile payments, and e-wallets, retailers can provide a seamless payment experience for their customers.

- Access to a wider range of payment options for customers: By accepting various forms of payment, retailers can provide their customers with more flexibility and convenience when making purchases. This, in turn, can increase customer satisfaction and loyalty.

- Increased sales and revenue: By accepting electronic payments, retailers can reach a wider audience and increase sales. Additionally, merchant services often provide tools for retailers to analyze sales data, which can help them make informed business decisions and improve profitability.

- Simplified accounting and record-keeping: Merchant services often provide retailers with detailed transaction reports, making it easier for them to track sales and manage their finances. This can save time and reduce the risk of errors when managing accounting and record-keeping tasks.

Overall, merchant services offer numerous benefits to retailers, helping them to improve their payment processing capabilities, increase customer satisfaction, and ultimately drive sales and revenue.

Factors to consider when choosing a merchant services provider

When choosing a merchant services provider, retailers should consider several factors, including the cost of services and fees associated with them, the level of customer support and service provided, and the compatibility with existing POS systems and hardware. Retailers should compare different providers to find the one that best meets their needs and budget.

Here are some factors that retailers should consider when choosing a merchant services provider:

- Cost of services and fees associated: Retailers should consider the cost of merchant services and any associated fees, such as transaction fees, monthly fees, and setup fees. They should compare pricing from different providers to find the most cost-effective solution for their business.

- Level of customer support and service provided: Retailers should consider the level of customer support and service provided by the merchant services provider. They should look for providers with responsive customer support teams and a reputation for excellent customer service.

- Compatibility with existing POS systems and hardware: Retailers should ensure that the merchant services provider is compatible with their existing point-of-sale (POS) systems and hardware. This can help to avoid costly hardware upgrades or software integrations.

- Security features: Retailers should consider the security features offered by the merchant services provider. They should look for providers that offer encryption technology, fraud detection tools, and other security measures to protect against data breaches and fraudulent transactions.

- Payment processing speed and reliability: Retailers should consider the speed and reliability of the payment processing service offered by the merchant services provider. They should look for providers with fast processing times and a low rate of payment errors.

By considering these factors, retailers can select a merchant services provider that meets their needs and helps to improve their payment processing capabilities, customer satisfaction, and ultimately, their bottom line.

Conclusion

Merchant services are an essential aspect of modern retail operations. By enabling businesses to accept electronic payments, merchant services provide numerous benefits, including increased efficiency and speed of payment processing, improved security, access to a wider range of payment options for customers, and simplified accounting and record-keeping.

When selecting a merchant services provider, retailers should consider several factors, such as cost, customer support, compatibility with existing systems, security features, and payment processing speed and reliability. By choosing the right provider, retailers can optimize their payment processing capabilities and enhance their customers' experience.

Overall, merchant services are critical for retailers seeking to improve their operations and increase profitability. By leveraging the latest payment processing technology and selecting the right provider, retailers can streamline their operations, reduce costs, and provide their customers with a seamless and secure payment experience.