CardPointe Payment Processing in Pleasanton

In today's fast-paced digital landscape, seamless and secure payment processing is paramount for businesses of all sizes. One of the leading players in the payment processing arena is CardPointe. This article delves into the world of CardPointe payment processing in Pleasanton, shedding light on its features, benefits, integration capabilities, and more.

What is CardPointe Payment Processing?

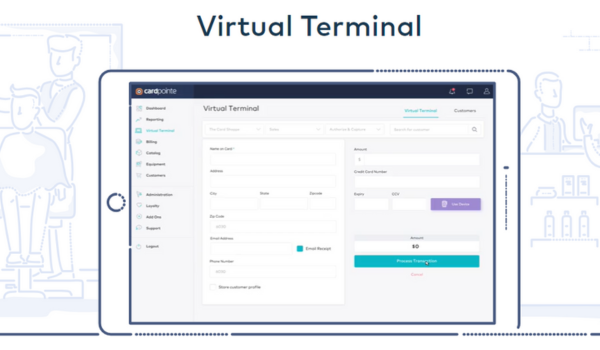

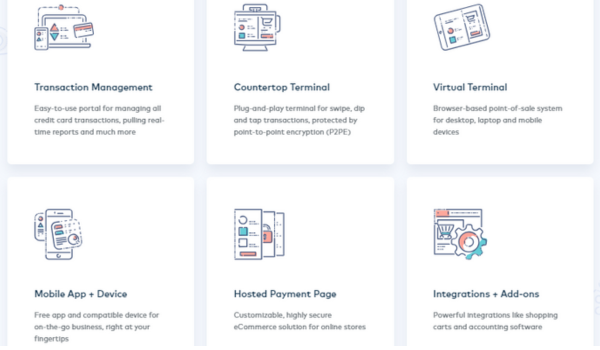

CardPointe payment processing in Pleasanton introduces a comprehensive platform that seamlessly integrates, accepts, and efficiently manages payments. Crafted to ensure streamlined functionality, this merchant processing solution provides users with a singular and intuitive portal. The CardPointe payment processing platform also seamlessly weaves in an abundance of integrations and add-ons, thereby amplifying its capabilities and augmenting convenience for customers. In its commitment to providing a seamless transaction experience, CardPointe payment processing emerges as the quintessential choice for a complete credit card processing solution.

How Does CardPointe Work?

CardPointe operates through a user-friendly web-based platform that facilitates payment processing. It allows merchants to accept payments online, in-store, or on-the-go through mobile devices. The platform seamlessly integrates with point-of-sale systems, e-commerce platforms, and other business tools, creating a unified payment experience.

Benefits of Using CardPointe

The benefits of using CardPointe as your payment processing solution are truly compelling and can greatly enhance your business operations.

Streamlined Transactions: CardPointe simplifies the payment process, enabling swift and hassle-free transactions. This means shorter checkout times for your customers, leading to increased customer satisfaction. With fewer obstacles in the payment journey, you can create a smoother shopping experience that encourages repeat business.

Enhanced Security Measures: Security is paramount in the digital age, especially when handling sensitive payment information. CardPointe takes this seriously by implementing advanced security protocols. This includes encryption technology that ensures payment data is encrypted during transmission, safeguarding it from potential threats and breaches. When customers feel that their information is secure, they're more likely to trust your business and its services.

Compliance Confidence: Staying compliant with industry regulations is crucial for any business that handles financial transactions. CardPointe is designed to meet the requirements of the Payment Card Industry Data Security Standard (PCI DSS). By choosing CardPointe, you're aligning your business with established security and compliance standards, giving both you and your customers peace of mind.

Tailored Customization: Your brand's identity matters, even in the realm of payment processing. CardPointe allows you to customize the payment experience to match your brand's look and feel. This means your customers experience a consistent visual journey, enhancing your professional image and brand recognition.

Real-time Reporting: Informed decisions are the backbone of successful businesses. CardPointe provides real-time reporting tools that offer detailed insights into transactions, settlements, and other key metrics. By having access to up-to-date information, you can make data-driven decisions that drive growth and profitability.

CardPointe Integration

Integrating CardPointe with your business is a strategic move that can streamline your payment processing operations and enhance the overall efficiency of your business. Here's a breakdown of how integrating CardPointe works and the benefits it brings:

1. Simplified Payment Process: When you integrate CardPointe with your business, you're essentially connecting its payment processing capabilities directly to your existing systems. This means that you can accept payments seamlessly through your point-of-sale (POS) systems, e-commerce platforms, mobile apps, and other channels. Customers can complete transactions smoothly without being redirected to a separate payment page.

2. Unified Payment Experience: Integrating CardPointe ensures a consistent and unified payment experience for your customers across different platforms. Whether they're making a purchase in-store, online, or via a mobile app, the process remains familiar and straightforward. This consistency enhances customer satisfaction and fosters trust in your brand.

3. APIs and Plugins: CardPointe provides Application Programming Interfaces (APIs) and plugins that facilitate integration with various systems. APIs are sets of tools and protocols that allow different software applications to communicate and interact seamlessly. Plugins, on the other hand, are pre-built software components that can be easily added to your existing software or website. These tools make the integration process more efficient and user-friendly.

4. Efficiency and Accuracy: Manual data entry can lead to errors and delays. Integrating CardPointe automates the payment process, reducing the likelihood of errors and minimizing the time required to process transactions. This increased efficiency benefits both your business and your customers.

5. Data Synchronization: Integrating CardPointe ensures that all transaction data is synchronized between your payment processing system and your other business systems, such as inventory management and accounting. This synchronization helps maintain accurate records and facilitates smoother overall business operations.

6. Time and Cost Savings: By eliminating the need for manual data entry and reconciliation, integrating CardPointe saves you valuable time and resources. You can allocate your resources to more strategic tasks, such as growing your business and improving customer experience.

7. Enhanced Analytics: Integrated systems provide you with comprehensive insights into your payment transactions. With CardPointe's integrated analytics, you can gain valuable information about customer behavior, popular products or services, and sales trends. These insights can guide your business decisions and strategies.

8. Flexibility and Scalability: As your business grows, your payment processing needs might change. CardPointe's integration capabilities offer the flexibility to adapt and scale according to your evolving requirements. Whether you expand to new locations or add more products to your catalog, the integrated system can accommodate these changes.

9. Improved Customer Experience: A seamless and hassle-free payment process contributes to a positive customer experience. Integrating CardPointe ensures that customers can pay quickly and easily, which can lead to higher customer satisfaction and potentially increased loyalty.

Integrating CardPointe with your business is a straightforward process. The platform offers APIs and plugins that facilitate seamless integration with popular e-commerce platforms and accounting software. This ensures a cohesive payment experience for both merchants and customers.

Payment Data Security: CardPointe’s Approach

CardPointe places a paramount emphasis on the security of payment data, implementing a robust array of measures to ensure that sensitive information remains protected throughout the payment process. Here's how CardPointe safeguards payment data:

Encryption Technology: CardPointe employs advanced encryption technology to secure payment data during transmission. When a customer initiates a transaction, their payment information is encrypted before it's sent over the internet. This encryption makes the data unreadable to unauthorized parties, ensuring that even if intercepted, the information remains secure.

Secure Sockets Layer (SSL): SSL is a cryptographic protocol that establishes a secure connection between a customer's browser and the merchant's website or application. CardPointe uses SSL to create an encrypted link, which prevents hackers from intercepting or tampering with the data being exchanged.

Payment Card Industry Data Security Standard (PCI DSS) Compliance: CardPointe adheres to the rigorous standards set forth by the Payment Card Industry Data Security Standard (PCI DSS). These standards are designed to ensure the security of payment card transactions. By complying with PCI DSS requirements, CardPointe demonstrates its commitment to maintaining the highest levels of security.

Tokenization: Tokenization is a process where sensitive payment data is replaced with a unique token. This token is meaningless to anyone who doesn't have the decryption key, providing an additional layer of security. Even if a hacker were to gain access to tokenized data, they wouldn't be able to use it without the corresponding key.

Secure Infrastructure: CardPointe operates on a secure and well-maintained infrastructure. This includes firewalls, intrusion detection systems, and other security mechanisms to prevent unauthorized access and protect against cyber threats.

Regular Security Audits: CardPointe conducts regular security audits and assessments to identify vulnerabilities and address potential risks. By staying proactive in identifying and rectifying security issues, CardPointe maintains a high level of security for payment data.

Multi-factor Authentication: Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of verification before gaining access to sensitive data or performing certain actions. CardPointe may incorporate multi-factor authentication to ensure that only authorized personnel can access sensitive information.

Ongoing Monitoring: Continuous monitoring of the CardPointe platform helps detect and respond to any unusual or suspicious activities. This proactive approach allows for rapid response to any potential security breaches.

Data Segmentation: CardPointe may segregate payment data from other types of data to minimize the risk of unauthorized access. This means that even if one part of the system is compromised, attackers won't necessarily gain access to all sensitive data.

Conclusion

Incorporating CardPointe Payment Processing in Pleasanton can truly redefine the way you handle transactions. With its secure and user-friendly features, you can experience a new level of convenience and efficiency. Upgrade your payment processing today and pave the way for a smoother, more streamlined business journey.