CardPointe Virtual Terminal in Pleasanton

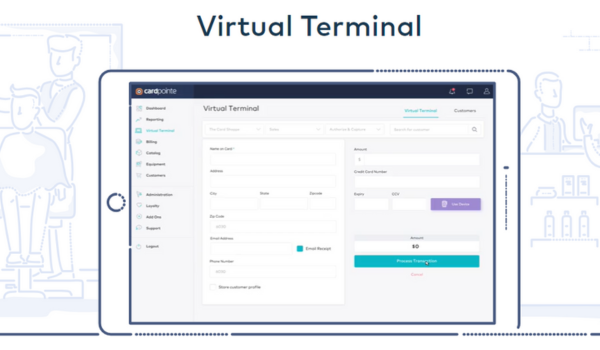

In today's fast-paced business landscape, efficient payment processing is essential for maintaining a seamless customer experience. CardPointe's virtual terminal has emerged as a game-changer, providing businesses with a convenient and secure way to accept payments. In this article, we'll explore the features, benefits, and functionalities of CardPointe's virtual terminal in Pleasanton, highlighting its role in streamlining payment processes and enhancing overall business operations.

In the digital age, where online transactions have become the norm, businesses require reliable and efficient payment processing solutions. CardPointe's virtual terminal offers a user-friendly platform that caters to both in-person and remote payment needs. Whether you're a small startup or an established enterprise, this innovative tool can revolutionize the way you handle transactions.

Understanding CardPointe Virtual Terminal

CardPointe's virtual terminal in Pleasanton is a cloud-based payment processing solution designed to simplify the payment acceptance process for businesses of all sizes. It serves as a versatile alternative to traditional point-of-sale (POS) systems, allowing merchants to accept payments from various sources, including credit and debit cards, e-checks, and mobile wallets.

How Does CardPointe Virtual Terminal Work?

Operating the CardPointe virtual terminal is straightforward. Merchants can access the platform through a web browser on their computer, laptop, or mobile device. Once logged in, they can manually enter payment details provided by customers or clients, regardless of whether the transaction occurs in person, over the phone, or through email.

Key Features of CardPointe Virtual Terminal

CardPointe Virtual Terminal boasts several key features that make it a standout solution for businesses seeking streamlined payment processing. These features are designed to enhance efficiency, security, and customer experience. Let's delve into the details of these key features:

Recurring Payments: For businesses that offer subscription-based services or regular billing cycles, CardPointe's virtual terminal offers a recurring payments feature. This enables automatic and scheduled billing, ensuring that payments are received on time without the need for manual intervention. This not only saves time for both businesses and customers but also minimizes the risk of missed payments.

Real-time Reporting: CardPointe empowers businesses with real-time reporting tools that provide valuable insights into transaction history, sales trends, and customer preferences. This data is instrumental in making informed business decisions, optimizing marketing strategies, and identifying areas for improvement. The ability to access and interpret data on-the-go is a game-changer for businesses aiming for growth.

Security Enhancement: Ensuring the security of sensitive payment information is paramount, and CardPointe addresses this concern with its robust security measures. The virtual terminal in Pleasanton employs tokenization and encryption techniques to protect customer data throughout the payment process. This level of security not only safeguards customer trust but also helps businesses meet industry compliance standards.

Flexibility: CardPointe's virtual terminal is built with flexibility in mind. It allows businesses to accept a wide range of payment methods, including credit and debit cards, e-checks, ACH transfers, and various mobile wallet options. This versatility caters to diverse customer preferences, ultimately leading to enhanced customer satisfaction and increased sales.

Cost-Efficiency: Unlike traditional point-of-sale (POS) systems that often require hardware investments, CardPointe eliminates the need for such expenditures. Businesses can access the virtual terminal via a web browser on existing devices, reducing upfront costs and ongoing maintenance expenses associated with physical terminals. This cost-effectiveness is particularly advantageous for small and medium-sized enterprises.

Customer Satisfaction: Simplifying payment processes directly contributes to improved customer experiences. With CardPointe's virtual terminal, customers can make payments seamlessly, whether in-person, over the phone, or through email. The convenience of multiple payment options coupled with the system's user-friendly interface enhances customer satisfaction and fosters loyalty.

Streamlined Operations: Manual payment entry and administrative tasks can be time-consuming and error-prone. CardPointe's virtual terminal automates many of these processes, freeing up valuable time and resources for businesses. Automating recurring payments, generating invoices, and accessing real-time data all contribute to more efficient operations.

Benefits for Businesses

The benefits offered by CardPointe Virtual Terminal to businesses are manifold, contributing to enhanced operations, customer satisfaction, and overall growth. Let's delve into the advantages that businesses can gain from adopting this innovative payment processing solution:

Flexibility: CardPointe's virtual terminal in Pleasanton brings unparalleled flexibility to businesses. It enables them to accept payments from various sources, including credit and debit cards, e-checks, ACH transfers, and mobile wallets. This versatility accommodates diverse customer preferences and purchasing behaviors, ultimately expanding the customer base.

Cost-Efficiency: Traditional point-of-sale (POS) systems often require substantial investments in hardware and maintenance. CardPointe eliminates these costs by providing a cloud-based solution accessible through existing devices. This cost-saving approach is particularly beneficial for small and medium-sized enterprises looking to optimize their budget.

Customer Satisfaction: Simplifying the payment process directly impacts customer satisfaction. With CardPointe's virtual terminal, customers can make payments seamlessly, regardless of whether they are physically present or making remote transactions. The convenience of multiple payment options and the system's user-friendly interface elevate the customer experience and foster loyalty.

Streamlined Operations: Manual payment entry and administrative tasks can be time-consuming and prone to errors. CardPointe's virtual terminal automates these processes, saving businesses valuable time and resources. Automation of recurring payments, invoicing, and access to real-time data contribute to more efficient operations and improved productivity.

Access to Data: Data-driven decision-making is crucial in today's competitive business landscape. CardPointe's real-time reporting tools offer businesses valuable insights into transaction history, sales trends, and customer behavior. Armed with this information, businesses can make informed decisions, optimize marketing strategies, and tailor offerings to customer preferences.

Security and Compliance: Protecting sensitive payment information is of paramount importance. CardPointe addresses security concerns through advanced security features such as tokenization and encryption. By complying with industry standards like the Payment Card Industry Data Security Standard (PCI DSS), CardPointe ensures customer data remains safe and builds trust.

Integration Capabilities: CardPointe's virtual terminal seamlessly integrates with various business management systems and e-commerce platforms. This integration facilitates smooth payment processing within existing infrastructure, eliminating the need for complex and time-consuming manual data entry.

Customer Convenience: With CardPointe, customers enjoy the convenience of choosing their preferred payment method, whether it's credit cards, e-checks, or mobile wallets. This flexibility enhances the buying experience, making it easier for customers to complete transactions and return for future purchases.

Data-Driven Insights: The real-time reporting and analytics provided by CardPointe allow businesses to identify trends, patterns, and opportunities. This information enables businesses to tailor their strategies, product offerings, and marketing efforts to better resonate with their target audience.

Operational Efficiency: By automating tasks such as recurring billing and generating invoices, CardPointe's virtual terminal streamlines operations. This leads to reduced manual effort, minimized errors, and optimized resource allocation, enabling businesses to focus more on their core activities.

Speed and Convenience: CardPointe's cloud-based nature eliminates the need for physical equipment and allows businesses to process payments quickly and conveniently. Whether it's in-store, online, or over the phone, transactions can be completed smoothly.

Payment methods supported by CardPointe

CardPointe Virtual Terminal supports a diverse range of payment methods, catering to the preferences of both businesses and their customers. This versatility in payment options ensures a seamless and convenient transaction experience. Here are the various payment methods that CardPointe supports:

Credit and Debit Cards: CardPointe enables businesses to accept payments made using major credit and debit cards, including Visa, Mastercard, American Express, and Discover. This comprehensive coverage ensures that customers can use their preferred cards to complete transactions.

E-Checks: E-checks, also known as electronic checks or ACH (Automated Clearing House) payments, provide an electronic alternative to traditional paper checks. CardPointe facilitates the acceptance of e-check payments, making it convenient for customers who prefer this method.

ACH Transfers: ACH transfers are electronic bank-to-bank transactions that facilitate direct transfers of funds between accounts. CardPointe's support for ACH transfers allows businesses to receive payments directly from customers' bank accounts, offering an additional layer of convenience.

Mobile Wallets: In the era of mobile technology, mobile wallets have gained popularity for their convenience and security. CardPointe recognizes this trend and supports payments made through mobile wallets such as Apple Pay, Google Pay, and Samsung Pay. Customers can simply use their smartphones to make secure and swift payments.

Contactless Payments: CardPointe's virtual terminal in Pleasanton also supports contactless payments, a method that has gained traction due to its hygienic and efficient nature. Customers can tap their contactless-enabled cards or smartphones at payment terminals, enabling quick and secure transactions.

Tokenization: While not a payment method per se, CardPointe incorporates tokenization as a security measure. Tokenization replaces sensitive payment data, such as credit card numbers, with unique tokens. This ensures that the actual data remains secure, even if the token is intercepted.

Recurring Billing: While not a payment method, CardPointe's support for recurring billing is worth mentioning. Businesses can set up automated recurring payments for subscription-based services or regular billings. This feature ensures timely payments without the need for customers to initiate transactions manually.

Conclusion

In a rapidly evolving business landscape, staying ahead requires embracing innovative solutions. CardPointe's virtual terminal in Pleasanton empowers businesses to enhance payment processing, improve customer experiences, and drive operational efficiency. By leveraging its features and benefits, businesses can focus on growth while providing a seamless payment experience.