CardConnect Integration Services in Pleasanton

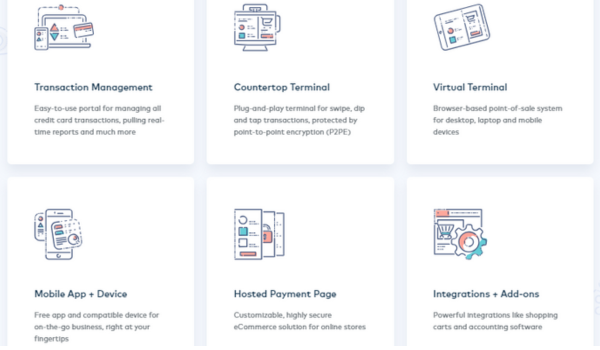

CardConnect is a payment processing and technology solution that enables businesses to accept credit card payments securely and efficiently. It provides various services such as payment processing, reporting, and data security. When it comes to accounting integration, it typically refers to the ability to seamlessly connect CardConnect's payment data and transaction information with accounting software.

Here are the steps to integrate CardConnect accounting

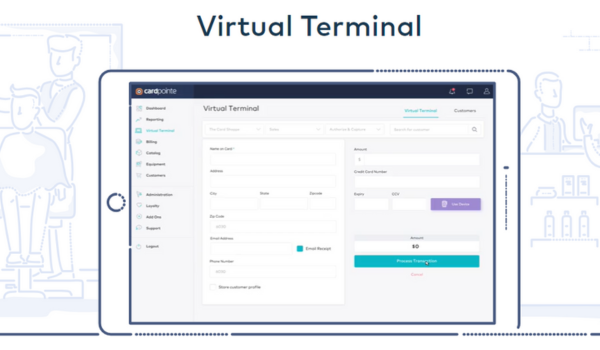

Transaction Data Syncing: CardConnect integrates with various accounting software, such as QuickBooks, Xero, and others. This integration allows transaction data, including sales, refunds, and other payment-related information, to be automatically synced from the CardConnect system to your accounting software.

Automation: Integrating CardConnect with your accounting software eliminates the need for manual data entry. Transactions that occur through CardConnect, whether online or in-person, are automatically recorded in your accounting system. This reduces errors, saves time, and improves accuracy in your financial records.

Reconciliation: The integration also helps with reconciliation. Reconciling transactions becomes easier since the payment data in your accounting software will match the data recorded in CardConnect's system. This makes it simpler to track incoming revenue and ensure that everything aligns with your financial records.

Reporting: Integrated systems can generate various financial reports, such as sales reports and revenue summaries, by pulling data from CardConnect's payment processing platform. This provides you with a comprehensive view of your financial performance.

Accounting Workflow Streamlining: With the integration, your accounting processes become more streamlined. You don't have to switch between different systems to manage payments and financial records separately. Instead, you can manage everything within your accounting software.

Security and Compliance: CardConnect typically employs strong security measures to protect payment data, which is crucial for maintaining compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard). When integrating with accounting software, these security measures extend to the data shared between systems.

Cost Efficiency: While there might be some initial setup and integration costs, the long-term efficiency gains usually outweigh these expenses. The time and effort saved from manual data entry and reconciliation can lead to cost savings in the long run.

Accounting integration with CardConnect might include

Automated Transaction Syncing: CardConnect's integration with accounting software allows for automatic synchronization of transaction data. This includes details such as sales, refunds, taxes, and fees. This feature minimizes manual data entry and reduces the risk of errors.

Real-Time Reporting: Integrated systems can provide real-time or near-real-time reporting of payment transactions. This allows you to keep track of your revenue and financial performance as transactions occur.

Reconciliation Tools: The integration might offer reconciliation tools that help match transactions in your accounting software with transactions processed through CardConnect.

Batch Processing: If you have a high volume of transactions, batch processing capabilities could be included. This feature allows you to group multiple transactions for processing and reporting purposes.

Payment Status Tracking: The integration might allow you to track the status of payments, such as pending, completed, or failed transactions. This visibility can help you manage customer orders and inquiries effectively.

Refund Management: You might be able to initiate and track refunds directly from your accounting software, streamlining the refund process and keeping your financial records consistent.

Customer Data Syncing: Some integrations offer the ability to sync customer data between CardConnect and your accounting software. This can be especially useful for tracking customer purchases and managing accounts receivable.

Automatic Fee Calculation: The integration might calculate payment processing fees automatically and include them in your financial reports. This feature helps you have a clear understanding of your net revenue.

Data Security: CardConnect's integration likely emphasizes data security, ensuring that sensitive payment information is transmitted and stored securely in compliance with industry standards like PCI DSS.

Multi-Channel Support: If your business operates through multiple sales channels (online, in-person, etc.), the integration might support all these channels, providing a consolidated view of your financial data.

Customization: Depending on the integration, you might have the ability to customize reports and dashboards to suit your specific accounting and business needs.

Training and Support: CardConnect may offer training resources and customer support to assist you in setting up and using the integration effectively.

Integration benefits

Seamless Payment Processing: Integration allows customers to make payments quickly and securely, enhancing their shopping experience.

Automated Record-Keeping: Transactions are automatically recorded in your accounting system, reducing manual data entry and the risk of errors.

Real-Time Reporting: Access to real-time sales data helps you monitor performance and make informed decisions.

Refund Management: Integration simplifies the refund process, improving customer service and operational efficiency.

Multi-Channel Consistency: Integration ensures that sales data from various channels (in-store, online, mobile) are consistent and up to date.

Strategies

Optimize Checkout Flow: Ensure the payment process is smooth and intuitive.

Promotions and Discounts: Integrate promotional offers and discounts directly into the POS system to apply them seamlessly during checkout.

Cross-selling and Upselling: Implement prompts during the checkout process to recommend related or complementary products, potentially increasing the average transaction value.

Customer Data Utilization: Leverage integrated customer data to personalize the shopping experience, such as sending targeted offers based on past purchases.

Inventory Management: Integrate inventory tracking with POS and payment data. This helps prevent overselling and provides insights into popular products.

Real-Time Analytics: Use real-time sales data to identify trends, peak sales times, and popular items. Adjust staffing and inventory accordingly.

Loyalty Programs: Integrate loyalty programs into the POS to reward repeat customers and encourage loyalty.

Mobile Integration: If applicable, integrate mobile payment options and allow customers to use their smartphones for transactions.

Contactless Payments: Emphasize contactless payment options, which are increasingly popular and offer a faster checkout experience.

Employee Training: Train staff to effectively use the integrated system to minimize errors and provide a seamless customer experience.

Security Measures: Highlight the security of CardConnect's integration to reassure customers that their payment data is safe.

Data Analysis for Growth: Regularly analyze integrated sales data to identify growth opportunities, refine pricing strategies, and adjust product offerings.

Customer Feedback Loop: Use integrated systems to gather customer feedback at checkout, helping you continuously improve your offerings and services.

Omnichannel Experience: Ensure a consistent experience across different sales channels by integrating online and in-store sales data.

Vendor Relationships: Use integrated sales data to negotiate better terms with suppliers based on purchasing trends.

Conclusion

CardConnect integration services in Pleasanton offer a gateway to streamlined and secure payment processing solutions. By seamlessly incorporating CardConnect's robust capabilities, businesses can unlock enhanced efficiency, reliability, and peace of mind in their financial transactions. Embracing these integration services paves the way for a more connected and convenient future in the world of payment processing.