Contactless and Mobile Payments for POS Systems

The Future of Payment Processing Contactless and Mobile Payments for POS Systems in today's fast-paced world, the way we pay for goods and services at the point of sale (POS) is rapidly evolving.

Read More

Restaurant Management with an Android POS System

An Android restaurant POS system is a point-of-sale system that uses Android operating system to process orders, manage inventory, and handle payments in a restaurant.

Read More

Restaurant POS system

A point of sale (POS) system is a software and hardware solution that restaurants use to manage their business operations, including processing orders, managing inventory, and processing payments.

Read More

Top Payment Processing Services

In today's digital age, accepting electronic payments is essential for businesses to thrive.

Read More

Restaurant POS Technology

Point of Sale (POS) technology is a type of software and hardware system that enables businesses to manage their sales transactions, including orders, payments, and inventory.

Read More

Wireless POS System

A wireless POS system is a type of point-of-sale system that uses wireless technology to process transactions and manage restaurant operations.

Read More

Choose the Right Payment Processing Service

CardConnect with Microsoft RMH integration is the best payment processing service for your POS system.

Read More

Top restaurants supplier

Restaurant businesses rely heavily on their suppliers to provide them with high-quality products and services at competitive prices.

Read More

Merchant services for Warehouse

Merchant services for warehouse operations refer to the various payment processing services offered to companies that operate warehouses.

Read More

Benefits of Real-Time Transaction

Payment processing is a critical aspect of any business, and it is essential to have a reliable and efficient Point of Sale (POS) system in place to ensure that transactions are processed accurately and securely.

Read More

Understanding EMV and PCI Compliance in Payment Processing for Your POS System

In the world of payment processing, there are two key acronyms that business owners need to understand: EMV and PCI.

Read More

The Advantage of Integrating Payment Processing Services with Your POS System

The advantage of integrating Payment Processing Services with your POS System with microsoft rmh and CardConnect integration is that it helps streamline checkout, improves customer experience, and reduces the risk of fraud.

Read More

Merchant Services For Auto Repair

In this blog we will learn about merchant services for auto repair. At Q paymentZ we specialize in payment processing solutions for the automotive industry.

Read More

Merchant Services Phone Number

In today's fast-paced business landscape it’s more important than ever for businesses to have reliable and efficient merchant services.

Read More

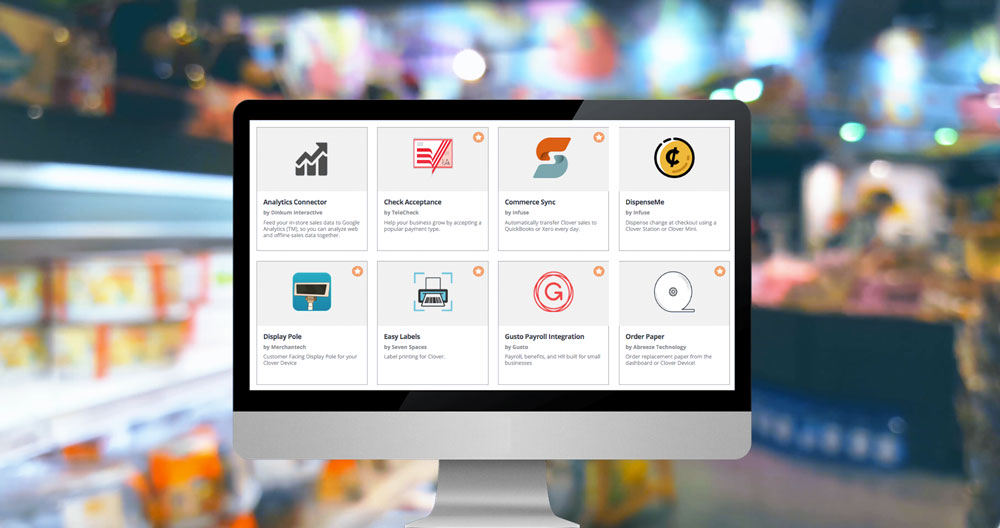

Clover Software

Clover software is a cloud-based android point-of-sale (POS) platform that develops various software products.

Read More

Clover Merchant App

Clover Merchant App is a comprehensive point-of-sale (POS) system designed for small and medium-sized businesses.

Read More

Microsoft RMH with card connect integration

Microsoft RMH with CardConnect Integration is a point-of-sale (POS) system that is integrated with CardConnect's secure payment processing solution.

Read More

Merchant services for online payments review

Merchant services for online payments have generally received positive reviews from customers.

Read More

Merchant services for online business reviews

Merchant Services for Online Business Reviews are necessary for online businesses to evaluate and compare different merchant service providers.

Read More

California Credit Card Merchant Services

If you're a business owner in California, you're likely aware of the importance of offering convenient payment options to your customers.

Read More

Merchant Services For Online Payments

Online payments have revolutionized the way people shop and do business. Today, businesses can accept payments from customers located anywhere in the world with ease.

Read More

California Credit Card Processing

The process of accepting credit card payments from customers in the state of California. This involves the use of a payment gateway, merchant account, and other financial tools to securely process the payment.

Read More

Merchant Services vs Square

Merchant services refer to a range of services that enable businesses to accept and process electronic payments, including credit and debit card processing, ACH payments, virtual terminals, and point-of-sale (POS) systems.

Read More

Merchant Services for Beauty Salons

With tailored solutions designed specifically for beauty salons, merchant service providers in California offer Merchant Services for Beauty Salons, including point-of-sale (POS) systems, payment gateways, and mobile payment solutions.

Read More