Virtual payment solutions in Pleasanton, CA

Virtual payment solutions in Pleasanton are digital transactions and payments without using physical cash or cards such as credit /debit cards. These solutions have made it more secure and convenient for financial transactions through digital wallets, mobile apps, and other electronic platforms. It can manage and track transactions digitally. The landscape of virtual payment solutions is continuously evolving and new technologies and methods are emerging.

Common types of Virtual payment solutions

There are so many types of virtual payment solutions available for transactions and payments.

Digital Wallets

Digital wallets are online payment tools in the form of apps or platforms that store your payment information such as card details or bank account information securely. This information is encrypted in a digital wallet platform and once the device is unlocked, the wallet is available for use once. Users can make their payments through smartphones or devices at compatible POS terminals.

QR Code payments

Nowadays QR code payments are increasingly popular. Users can easily scan the QR code at the checkout point or in-store to make the payments. This QR code scan can be done by customers through smartphones. Once the QR code is scanned, the payment page will appear and they will have the option to pay their payments. Before scanning the QR code, ensure it has not been tampered with. So we can avoid the scamming of payment.

Online payment gateway

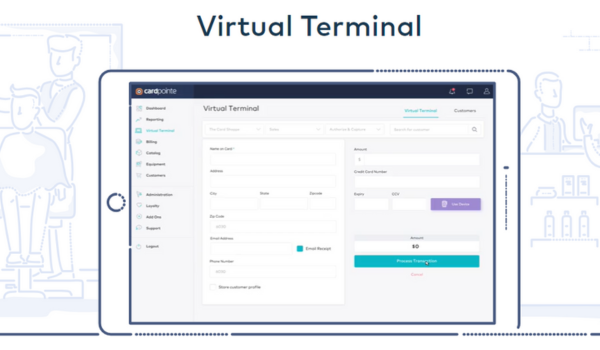

This solution is used to accept payments online on their websites. It offers a secure way of payments to its customers while payment is done through credit cards, debits, and digital wallets. When customers place an order through the website by pressing the submit order or equivalent option, it goes to the payment processing page. On that payment processing page, customers must enter their card details such as card number, CVV, and expiry date. This information is sent between the browser and the merchant’s webserver and the web server encrypts the customer’s information. The transaction has been done online on further processing on the payment page.

Peer-to-peer payment apps

Peer-to-peer payment apps are electronic money transfer methods from one person to another person through an intermediary. It offers a convenient alternative method to traditional payment methods. These payments are sent and received through mobile devices or computers with internet access. The user first downloads the application and creates an account with details such as a credit card, debit card, or bank account to link it to the app. Then the user can add the contact in the app and send the payment to another person through an email address, phone number, or account handled by the other user. During the transaction process, money is debited from the user's bank account to complete the transaction.

Cryptocurrencies

This payment solution is also known as a digital currency exchange. It is one of the businesses that allows the customers to trade the cryptocurrency for the other assets. Cryptocurrency offers to earn passive income for the owner through staking. Digital currency exchanges are strictly online businesses. Through these online businesses, money or digital currencies are exchanged electronically.

Need for Virtual payment solutions

Virtual payment solutions in Pleasanton play an important role in today’s digital economy. It provides a more convenient, secure, and efficient way of payment to individuals and business persons to make financial transactions

Convenience

Virtual payment solution provides a more convenient method for payment transactions. By using smartphones, tablets, or computers, user can make their payment from their convenient places such as their home or on the way so users can avoid physically visiting the bank or payment center so the time consumption of this process is low.

Global Access

By using this virtual payment solution option, users can enable their transactions across borders. So they can send and receive the money internationally without any hassle. This payment method is especially important for businesses engaged in global trade.

Contactless payments

Virtual payment solution includes a wireless financial transaction that is contactless payments such as mobile apps, digital wallets, and QR code payments. It offers a tough-free way of purchasing products or services and enhances safety and hygiene.

Business efficiency

Virtual payment solutions provide streamlined operations by automating processes like invoicing, payment reconciliation, and payroll distribution. This will lead to an increase in the efficiency of the business and reduce the administrative cost. Also, the cash flow of the company will increase.

Reduced the paperwork

This payment method minimizes the necessity of paperwork such as check writing, printing the invoices, and generating the physical receipt. This approach not only saves time for the users but also in a more environmentally friendly manner.

Innovation

This method is one of the forefront of financial innovation. As technology evolves, these solutions continue to adapt and incorporate emerging technologies such as blockchain, cryptocurrencies, and biometrics.

Virtual payment solutions offer a modern and efficient way to handle financial transactions, catering to the needs of both consumers and businesses in an increasingly digital and interconnected world.

Applications of Virtual payment

Virtual payment solutions are used in a wide range of applications such as various business industries and scenarios. The convenience of this payment solution continues to drive their adoption in both consumer and business contexts.

E-commerce and online retail businesses

Virtual payment solutions play an important role in E-commerce and online retail businesses. It provides a convenient and secure way of payment for both customers and business users. It also provides the option to customers to save their payment information securely, so users speed up their check-out process and reduce the time.

Gaming and Entertainment

Virtual payment solutions have transformed the way payments are made in the gaming and entertainment industry. They provide gamers and entertainment enthusiasts with seamless and efficient ways to make purchases. Virtual payment solutions are also integrated into online gaming platforms for purchasing in-game items. So they enable the micro transactions and enhance the gaming experience. Online gaming marketing enables players to buy and sell their gaming items, accounts, and currencies.

Subscription Services

This payment solution is also used for subscription-based services. This solution offers a convenient and automated way for customers to access the payment for ongoing services. Automated Clearing House (ACH) payments allow customers to link their bank accounts to subscription services for automatic withdrawals. Virtual payment solutions enable tracking and billing for such usage-based subscriptions. These virtual payment solutions contribute to the growth of subscription-based business models by providing a seamless and user-friendly way for customers to access and pay for ongoing services.

Travels and Hospitality

Virtual payments are used for booking flights, hotels, rental cars, and other travel-related services. They provide convenience for travelers, often with additional benefits like loyalty points. Payments are done at the time of booking and it ensures that the reservations are secured. Travel insurance providers offer virtual payment options for purchasing coverage plans. So travelers can select and pay for insurance plans online. It contributes to a smoother travel experience by minimizing the need for physical cash and reducing the friction in the payment processing.

B2B payment

Virtual payment solutions have become integral to streamlining B2B (business-to-business) payments, offering efficiency, security, and cost savings for businesses of all sizes. It enhances the B2B payment process, reducing manual work, errors, and delays while improving financial control and visibility for businesses. Business payment networks offer platforms for companies to send and receive electronic payments, often with features for invoice management and reconciliation.

Bill payments

This solution is highly beneficial for bill payment applications and offers a convenient and efficient way to manage and settle their payment. Users can link their bank accounts or credit/debit cards to make payments seamlessly and can view and pay all their bills within a single platform. Virtual prepaid cards can be generated for bill payments, providing an added layer of security and preventing the exposure of primary payment information.

Healthcare and Telemedicine

Virtual payment solutions have transformed the healthcare and telemedicine sectors, providing patients with convenient ways to pay for medical services and enabling healthcare providers to streamline their billing processes. Healthcare providers offer online patient portals that allow patients to view their medical bills, and insurance claims, and make payments electronically. It prioritizes security and compliance with healthcare regulations, protecting sensitive patient data.

Conclusion

A virtual payment solution in Pleasanton is one of the digital methods of making payments without the need for physical cash or traditional payment methods like credit or debit cards. These solutions leverage technology to facilitate secure and convenient transactions in various contexts. It offers several benefits, including enhanced security, ease of use, and the ability to track and manage transactions digitally. It's important to note that the adoption and availability of virtual payment solutions can vary by region and industry. Users should also be mindful of security best practices and the terms associated with each virtual payment method.