CardPointe Mobile Payment Processing: Empowering Businesses

In this era of digital transformation, where flexibility and adaptability are key, CardPointe's mobile payment processing empowers you to stay ahead of the curve. Say goodbye to cumbersome hardware and hello to a world of freedom where your business is no longer confined by location. Join us as we delve into the realm of hassle-free mobile payments and unlock a world of possibilities with CardPointe.

In a world where smartphones have become extensions of our lives, it's no surprise that businesses are capitalizing on the mobile revolution to streamline their operations. Mobile payment processing, exemplified by solutions like CardPointe, is at the forefront of this transformation.

Understanding CardPointe Mobile Payment Processing

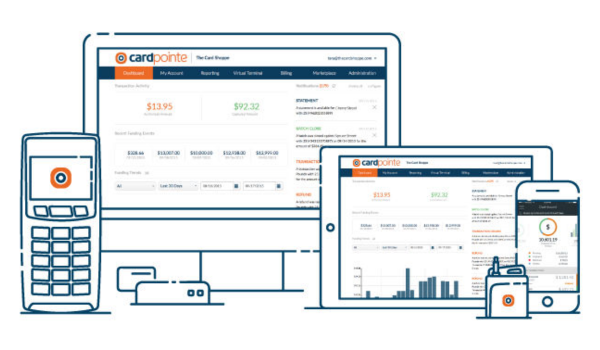

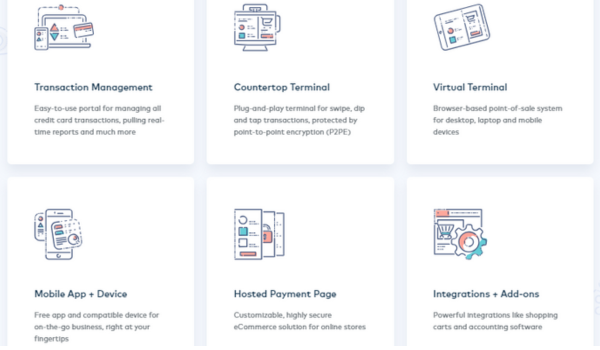

CardPointe is a comprehensive mobile payment processing solution that enables businesses to accept payments anytime, anywhere. It combines the power of hardware and software to create a seamless transaction experience. With CardPointe, businesses can accept various payment methods, including credit and debit cards, mobile wallets, and even contactless payments.

Benefits of Mobile Payments

Embracing mobile payment processing offers a range of advantages that can significantly benefit businesses and enhance the overall customer experience. Here are some key benefits of going mobile with payments:

Increased Convenience: Mobile payment solutions allow customers to make transactions on the go, eliminating the need to carry physical wallets or cards. This convenience translates to quicker and hassle-free purchases, enhancing customer satisfaction.

Efficiency: Mobile payments are processed in real-time, reducing waiting times during checkout. This efficiency is particularly valuable during peak business hours, preventing long lines and ensuring a smoother shopping experience for customers.

Versatility: Mobile payment solutions support various payment methods, including credit and debit cards, mobile wallets, and contactless payments. This versatility accommodates different customer preferences and fosters inclusivity.

Inventory Management: Many mobile payment systems offer integrated inventory management features. This enables businesses to track sales in real-time, manage stock levels, and make informed decisions about restocking or discontinuing certain products.

Reduced Costs: Implementing mobile payment solutions can lead to cost savings over time. Traditional point-of-sale systems often involve hardware maintenance and rental fees. Mobile payments, on the other hand, require minimal hardware and can be more cost-effective in the long run.

Enhanced Mobility: Businesses that rely on in-person transactions, such as food trucks or pop-up shops, can benefit greatly from mobile payment solutions. They allow these businesses to accept payments wherever they go, expanding their reach and increasing sales opportunities.

Quick Transactions: Mobile payments can be completed in a matter of seconds. This speed is especially advantageous in industries where speed is crucial, such as the fast-food sector or events with limited timeframes.

Digital Recordkeeping: Mobile payments generate digital receipts and transaction records, reducing paper waste and offering a more organized way of tracking financial transactions. This can streamline accounting processes and make recordkeeping more efficient.

Customer Loyalty Programs: Many mobile payment solutions offer integration with customer loyalty programs. This encourages repeat business by rewarding customers for their continued patronage, thereby increasing customer retention rates.

Contactless Payments: In a post-pandemic world, contactless payments have gained even more significance. Mobile payment solutions often support contactless transactions, minimizing physical contact between customers and payment terminals.

Global Reach: With the rise of e-commerce and online businesses, mobile payments enable companies to expand their reach globally. Customers from different parts of the world can easily make payments using their preferred methods.

Real-time Insights: Mobile payment systems often come with analytics and reporting features. Business owners can gain insights into sales trends, peak transaction times, and popular products, allowing for informed decision-making.

Competitive Advantage: Adopting mobile payment solutions showcases a commitment to innovation and convenience. This can give businesses a competitive edge by attracting tech-savvy customers and setting them apart from competitors.

Ease of Integration: Many mobile payment solutions integrate seamlessly with existing point-of-sale systems and e-commerce platforms. This means businesses can transition to mobile payments without a major overhaul of their operations.

How to Get Started with CardPointe

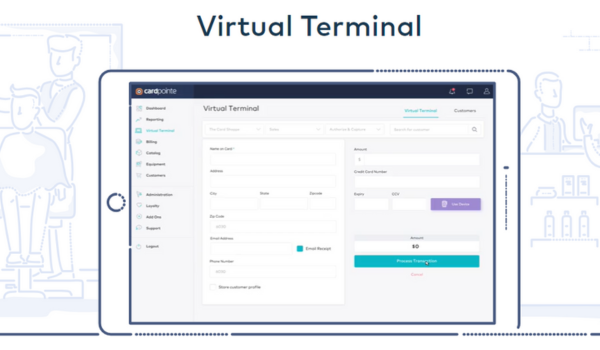

Getting started with CardPointe is a straightforward process. After signing up, businesses receive the necessary hardware and can easily integrate the software into their existing systems. The system is designed to be user-friendly, making it accessible even for those with limited technical knowledge.

Security Measures to Safeguard Transactions CardPointe prioritizes the security of transactions. Advanced encryption techniques, tokenization, and fraud detection mechanisms work in tandem to protect sensitive customer information and prevent unauthorized access.

Integration with E-commerce Platforms

Integration with e-commerce platforms refers to the seamless incorporation of mobile payment solutions into online retail websites and applications. This integration enhances the customer shopping experience and streamlines the payment process, contributing to increased sales and customer satisfaction. Here's a closer look at the concept of integration with e-commerce platforms:

Seamless Shopping Experience: When a mobile payment solution is integrated with an e-commerce platform, customers can complete their purchases without being redirected to external payment pages. This creates a seamless and uninterrupted shopping experience, reducing friction and potential drop-offs during the checkout process.

Efficient Checkout: Integrated mobile payments simplify the checkout process by pre-filling payment details, such as credit card information and shipping addresses, if the customer has previously saved them. This reduces the number of steps required to complete a purchase, making the process faster and more convenient.

Single Platform Management: Businesses can manage both their products and payments from a single platform. This simplifies administrative tasks, such as adding new products, updating prices, and monitoring inventory levels, without the need for separate payment processing systems.

Enhanced Security: Integrating mobile payment solutions with e-commerce platforms ensures a higher level of security. Customer payment information is securely stored and processed through encrypted channels, reducing the risk of data breaches and fraud.

Real-time Order Processing: Integration allows for real-time order processing and confirmation. As soon as a payment is made, the system can update the order status and trigger the fulfillment process, providing customers with immediate feedback and reducing any delays in shipment.

Consistency Across Channels: Many businesses operate through multiple channels, such as physical stores, websites, and mobile apps. With integrated payment solutions, the payment experience remains consistent across all these channels, fostering trust and familiarity with customers.

Mobile Optimization: As mobile commerce continues to grow, having an integrated mobile payment solution ensures that the payment process is optimized for mobile devices. This includes responsive design and mobile-friendly interfaces, providing a smooth experience for customers using smartphones or tablets.

Reduced Abandonment Rates: Complex or time-consuming payment processes can lead to cart abandonment. Integration with e-commerce platforms minimizes the steps required to complete a purchase, reducing the likelihood of customers abandoning their carts before finalizing transactions.

Payment Gateway Flexibility: E-commerce platforms often support various payment gateways, allowing businesses to choose the one that best fits their needs. Integrated mobile payment solutions can seamlessly integrate with these gateways, providing flexibility in payment options.

Customer Data Utilization: Integrated systems can collect and analyze customer data, providing insights into purchasing behaviors, preferences, and trends. This data can be used to personalize marketing strategies and tailor offers to individual customers.

Simplified Reporting: Integrated solutions offer consolidated reporting, allowing businesses to track sales, revenue, and transaction data within the same platform. This simplifies financial analysis and reporting processes.

User-Friendly Interface: An integrated payment solution maintains the look and feel of the e-commerce platform, ensuring a consistent and user-friendly interface for customers. This familiarity helps build trust and confidence during the payment process.

The Future of Mobile Payment Processing

The future of payment processing is undoubtedly mobile. As technology continues to advance, businesses that adopt mobile payment solutions like CardPointe are poised to stay ahead of the curve. Consumers' reliance on smartphones for everyday tasks further underscores the significance of mobile payment processing.

Conclusion

CardPointe mobile payment processing is a game-changer for businesses seeking agility, flexibility, and enhanced customer experiences. As the world continues to embrace mobile technology, businesses that incorporate CardPointe into their operations position themselves for success. With its seamless integration, robust security measures, and array of features, CardPointe is at the forefront of the mobile payment revolution.