ACH Payment Processing in Pleasanton: Simplifying Transactions

In the modern era of finance, businesses are constantly seeking efficient and secure ways to handle transactions. ACH (Automated Clearing House) payment processing has emerged as a solution that not only streamlines payments but also enhances the overall financial management of businesses in Pleasanton.

Understanding ACH Payment Processing

Unveiling the ACH Network

In the realm of modern finance, the ACH Network stands as a pivotal system that underpins the efficient movement of funds across the United States. "ACH" stands for Automated Clearing House, and this network serves as a sophisticated electronic infrastructure that facilitates seamless, secure, and swift financial transactions between various financial institutions.

Understanding the ACH Network

Imagine the ACH Network as a digital highway connecting banks, credit unions, and other financial entities. This network is the engine behind a wide array of financial activities, such as direct deposits, bill payments, business-to-business transactions, and more. Instead of relying on physical checks or cash, the ACH Network empowers businesses and individuals to initiate and receive transactions electronically.

The Mechanics of the ACH Network

When a transaction is initiated through the ACH Network, it follows a well-defined process. First, the originator—whether it's an individual, business, or institution—submits an electronic payment instruction. This instruction contains details such as the recipient's bank information, transaction amount, and purpose of payment.

The instruction travels through the ACH Network, arriving at the originating bank's ACH operator. This operator sorts and groups transactions, preparing them for batch processing. Batches of transactions are then submitted to the Federal Reserve or Electronic Payments Network (EPN) for clearing.

Once cleared, the transactions are routed to the recipients' financial institutions through the ACH Network. The receiving banks process the transactions, ensuring funds are accurately credited to the recipients' accounts. This entire process is completed electronically, eliminating the need for paper-based checks and reducing the time it takes for funds to move between accounts.

The Advantages of the ACH Network

The ACH Network brings forth a host of benefits that contribute to the efficiency and convenience of modern financial transactions:

- Speed: Compared to traditional methods like physical checks, ACH transactions are significantly faster, often taking just a day or two to clear.

- Cost Savings: ACH payments are more cost-effective than paper-based transactions, as they reduce the need for paper, postage, and manual processing.

- Automation: The ACH Network allows for automated recurring transactions, such as payroll deposits and subscription payments, making financial management smoother.

- Accuracy: The electronic nature of ACH payments minimizes the risk of errors that can occur with manual processing.

- Security: The ACH Network employs robust security measures to protect sensitive financial information, enhancing the overall safety of transactions.

Swift and Cost-Effective Transactions

In the dynamic landscape of modern finance, the concept of "swift and cost-effective transactions" has emerged as a hallmark of efficiency and convenience. This phrase encapsulates the seamless movement of funds between entities in a manner that not only accelerates the process but also minimizes the associated expenses.

Understanding Swift Transactions

"Swift" in this context refers to speed—transactions that are executed rapidly and without unnecessary delays. In the traditional realm of finance, certain transactions, such as paper-based checks, could take days or even weeks to clear. Swift transactions, on the other hand, leverage modern technology to expedite this process. Through electronic networks and platforms, funds can be transferred from one account to another in a matter of hours, if not minutes. This speed is particularly crucial in scenarios where time-sensitive payments or exchanges are required.

The Advantages of Swift Transactions

Efficiency: Swift transactions streamline the exchange of funds, reducing the time it takes for money to move between accounts. This efficiency is particularly valuable for businesses and individuals who rely on timely payments.

- Reduced Risk: The faster funds are transferred, the lower the risk of errors or disruptions in the payment process. Swift transactions contribute to greater accuracy and reliability in financial exchanges.

- Enhanced Business Operations: For businesses, swift transactions mean better cash flow management. Expedited payments enable companies to meet their financial obligations promptly and maintain stable operations.

- Customer Satisfaction: In consumer-oriented industries, swift transactions contribute to improved customer satisfaction. People appreciate the convenience of rapid payments, whether it's for receiving their paychecks or making purchases online.

Understanding Cost-Effective Transactions

In the realm of finance, "cost-effective transactions" refer to processes that minimize the expenses associated with transferring funds or conducting financial activities. Traditionally, certain forms of payment, such as mailing paper checks, involve additional costs like postage, printing, and manual processing. Cost-effective transactions seek to minimize these expenses through technological advancements.

The Advantages of Cost-Effective Transactions

Reduced Overhead: Cost-effective transactions reduce the need for physical resources, such as paper and postage. This results in lower overhead costs for businesses and financial institutions.

- Savings for Consumers: Individuals also benefit from cost-effective transactions. Reduced fees and charges make financial activities more accessible and affordable.

- Environmental Impact: By reducing the reliance on paper-based processes, cost-effective transactions contribute to environmental sustainability. Less paper usage leads to less waste and a smaller carbon footprint.

- Business Competitiveness: Organizations that offer cost-effective transaction options are more appealing to customers. Such businesses are seen as innovative, customer-centric, and forward-thinking.

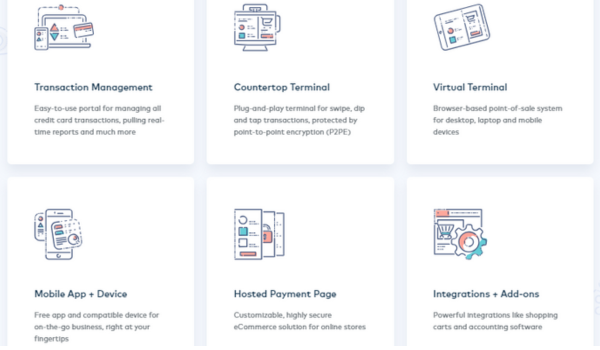

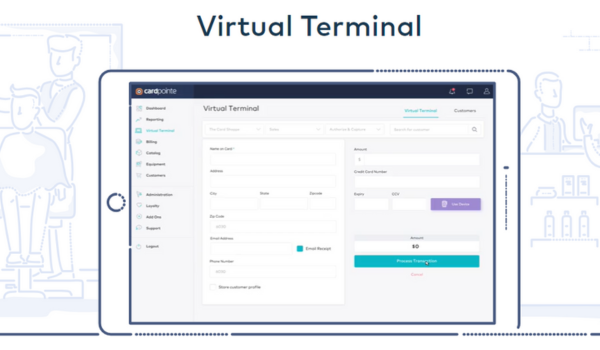

Payment Versatility

"Payment versatility" is a term that highlights the diverse range of payment options available to individuals and businesses for conducting transactions. In today's interconnected world, the ways in which we exchange money have expanded beyond traditional methods, offering a plethora of choices to suit different needs and preferences.

Understanding Payment Versatility

Payment versatility signifies the ability to choose from various methods when making a payment or receiving funds. While traditional options like cash and checks still exist, modern technological advancements have introduced a wide array of electronic payment options that cater to the evolving demands of consumers and businesses.

Exploring Electronic Payment Options

Credit and Debit Cards: Perhaps the most common form of electronic payment, credit and debit cards allow individuals to make purchases both in-person and online. The convenience of swiping or inserting a card, coupled with the security features, makes cards a preferred choice.

- Mobile Wallets: Mobile wallets, accessed through smartphones, have gained significant popularity. These apps store payment card information securely, allowing users to make contactless payments using near-field communication (NFC) technology.

- Digital Wallets: Similar to mobile wallets, digital wallets facilitate online transactions. They store payment information and enable quick and secure checkout processes on e-commerce platforms.

- Bank Transfers: Electronic bank transfers, often done through online banking platforms, enable direct movement of funds between bank accounts. This method is commonly used for paying bills and making person-to-person transfers.

- Peer-to-Peer Payment Apps: Apps like Venmo, PayPal, and Cash App allow individuals to send money to friends, family, or colleagues quickly and easily using their email addresses or mobile numbers.

- Crypto currencies: The rise of cryptocurrencies has introduced a new dimension to payment versatility. Digital currencies like Bitcoin and Ethereum offer decentralized and borderless transactions.

Advantages of Payment Versatility

- Convenience: Payment versatility ensures that individuals can choose the method that aligns with their convenience and preferences, whether it's using a card, mobile app, or digital wallet.

- Accessibility: Different payment options cater to different demographics. Payment versatility ensures that everyone, regardless of their banking status, can engage in financial transactions.

- Security: Many electronic payment options come with robust security features, including encryption and authentication methods, safeguarding both the payer's and payee's information.

- Global Transactions: Some payment methods, like cryptocurrencies, facilitate international transactions without the need for currency conversion or lengthy processing times

Enhancing Cash Flow Management

Pleasanton businesses can harness the power of ACH payment processing to optimize their cash flow management. With automated and predictable payment schedules, businesses can better plan their finances and allocate resources effectively.

Reducing Payment Delays

Late payments can disrupt business operations and strain relationships with vendors and employees. ACH payment processing minimizes the chances of payment delays by offering a reliable and automated payment method.

Strengthening Security Measures

Security is a top priority in financial transactions. ACH payments adhere to stringent security standards, reducing the risk of fraud and unauthorized access. This level of security provides businesses and their clients with peace of mind.

Conclusion

In conclusion, ACH Payment Processing in Pleasanton, both as individual components and when used together, represents a modern and efficient solution for businesses. With its speed, versatility, and security features, ACH payments simplify the payment process and contribute to overall business growth.