CardConnect Integration Services in Pleasanton

CardConnect's integration services in Pleasanton for point-of-sale (POS) systems involve connecting their payment processing technology with your POS software or hardware to enable seamless and secure payment transactions. This integration allows businesses to accept credit and debit card payments as well as other electronic payment methods directly through their POS system.

The CardConnect POS integration services are as follows

APIs and SDKs: CardConnect typically provides APIs and SDKs that developers can use to integrate their payment processing services into your POS software. APIs (Application Programming Interfaces) are sets of tools and protocols that allow different software systems to communicate with each other. SDKs (Software Development Kits) are packages that include pre-built code libraries, documentation, and resources to make integration easier for developers.

Payment Authorization: When a customer makes a payment using a credit or debit card at the POS, the POS system sends a payment authorization request to CardConnect's payment gateway via the API. CardConnect's systems then process the transaction and respond with an approval or decline message.

Card Present and Card Not Present Transactions: CardConnect's integration supports both card-present transactions (swiping or inserting physical cards) and card-not-present transactions (online or over-the-phone payments).

Security: CardConnect emphasizes security in payment processing. They offer encryption and tokenization solutions to protect sensitive cardholder data during transmission and storage. This helps businesses maintain compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements.

EMV Compliance: CardConnect's integration services for POS systems often include support for EMV (Europay, Mastercard, and Visa) chip card technology. This enhances security and reduces liability for fraudulent transactions.

Contactless Payments: Many modern POS systems and CardConnect's integration services support contactless payment methods like NFC (Field Communication) payments using mobile wallets or contactless cards.

Testing and Certification: CardConnect typically provides testing environments where businesses can simulate transactions to ensure the integration works smoothly before going live. This helps identify and fix any issues before real-world transactions.

Reporting and Analytics: CardConnect's integration might provide access to transaction data and reporting, allowing businesses to analyze sales trends, track revenue, and manage their financials.

Support and Documentation: CardConnect usually offers technical support and detailed documentation to guide developers through the integration process.

Customization: Depending on the integration level, businesses may have the opportunity to customize the payment experience, such as branding, receipt formatting, and user interface.

CardConnect offers integration services designed to enhance point-of-sale (POS) systems with comprehensive payment processing capabilities. These features enable businesses to seamlessly accept various forms of electronic payments through their POS terminals. While specific features may evolve, here are common features associated with CardConnect's integration services in the POS context.

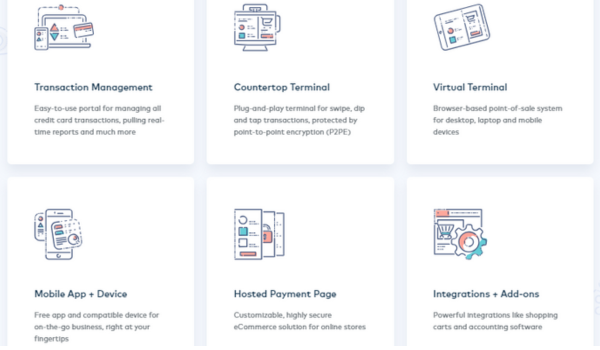

Enhance your Business with our features

Multi-Payment Acceptance: CardConnect's integration services enable businesses to accept a wide range of payment methods, including major credit cards, debit cards, EMV chip cards, mobile wallets (such as Apple Pay and Google Pay), and contactless payments.

EMV Chip Card Support: EMV technology enhances security by using embedded microchips in payment cards to generate unique transaction codes, reducing the risk of card cloning and fraud. CardConnect's integration allows businesses to process chip card transactions.

Contactless Payments: Integration supports contactless payments, where customers can make transactions by tapping their contactless cards or mobile devices near the POS terminal.

Encryption and Tokenization: CardConnect employs encryption to protect sensitive cardholder data during transmission and storage. Tokenization replaces card data with unique tokens, reducing the risk associated with storing actual card numbers.

Card Present and Card Not Present Transactions: Businesses can process transactions where the customer's physical card is present or even when card data is entered manually (card-not-present transactions).

PCI Compliance: CardConnect's integration services help businesses meet Payment Card Industry Data Security Standard (PCI DSS) compliance requirements, which are essential for maintaining the security of payment data.

Transaction Reporting and Analytics: The integration often provides access to detailed transaction reports and analytics, offering insights into sales trends, peak transaction times, and customer preferences.

Customizable Interface: Depending on the level of integration and your POS system's capabilities, you may have the option to customize the payment interface's appearance, branding, and user experience.

Receipt Management: Businesses can generate digital receipts for customers and even offer options for email or SMS receipts.

Offline Mode: In some cases, CardConnect's integration allows for limited offline processing, ensuring that transactions can be conducted even if the internet connection is temporarily lost.

Real-time Authorization: CardConnect's integration services facilitate real-time communication with their payment gateway for quick and accurate authorization of transactions.

Testing Environments: CardConnect typically provides sandbox or testing environments, allowing developers to test the integration thoroughly before implementing it in a live environment.

Technical Support and Documentation: CardConnect usually offers technical support and comprehensive documentation to guide developers through the integration process and troubleshoot any issues.

Integrate with Insights CardConnect

Boosting CardConnect integration services involves maximizing the value, efficiency, and effectiveness of their payment processing solutions within your business operations. Here are several strategies to enhance your CardConnect integration and make the most of their services:

Clear Business Objectives: Clearly define your business goals for integrating CardConnect's services. Whether it's improving customer experience, streamlining operations, or increasing security, having a clear objective guides your integration strategy.

Thorough Planning: Plan the integration process carefully. Define key milestones, allocate resources, and establish a timeline for implementation.

Choose the Right Integration Type: Select the integration type that aligns with your business model. Consider whether a fully integrated solution, semi-integrated solution, or other options suit your needs best.

Prioritize User Experience: Ensure that the integration enhances the user experience for both customers and staff. A user-friendly interface and smooth payment process can make a significant difference.

Security and Compliance: Implement security features such as encryption and tokenization to protect sensitive payment data. Adhere to PCI DSS standards to ensure compliance and build trust.

Customization: Leverage CardConnect's customization options to create a payment experience that aligns with your brand identity and customer preferences.

Engage Technical Experts: Involve experienced developers or technical experts who are well-versed in integrating payment solutions. Their expertise can ensure a smooth and error-free integration.

Thorough Testing: Rigorously test the integration in a controlled environment before deploying it live.

Staff Training: Provide training to your staff on how to use the integrated payment system effectively. This ensures a seamless transition and consistent customer service.

Monitoring and Analytics: Set up mechanisms to monitor the performance of the integrated solution. Utilize the reporting and analytics features to gain insights into transaction patterns and customer behavior.

Continuous Improvement: Regularly assess the integration's performance and gather feedback from customers and staff.

Promote Security Features: Highlight the security features of CardConnect's integration services to build trust with customers. Emphasize the protection of their payment information.

Marketing and Communication: Communicate the enhanced payment options and features to your customers. Highlight the convenience and security of the integrated solution.

Stay Updated:Keep abreast of any updates, enhancements, or new features that CardConnect offers. These updates could provide additional benefits for your business.

Measure ROI: Evaluate the return on investment from the integration. Measure improvements in efficiency, customer satisfaction, and overall business performance.

Provide Customer Support: Offer support channels for customers who might have questions or encounter issues during the payment process.

Conclusion

CardConnect integration services in Pleasanton offer businesses a comprehensive and efficient solution for seamlessly incorporating payment processing capabilities into their operations. By integrating CardConnect's services into point-of-sale systems, e-commerce platforms, and mobile applications, businesses can enhance customer experiences, streamline operations, and ensure secure and compliant payment transactions.